What's New

New Requirement – Attaching an Explanation of Benefits (EOB) to Secondary and Tertiary Claims

Effective, January 1, 2026, when billing, adjusting or voiding Wyoming Medicaid secondary and tertiary claims, you must attach all applicable EOBs to the claims regardless of the submission type referenced below:

- Direct Data Entry (DDE)

- Paper

- Refer to Wyoming Medicaid Provider Manuals for Electronic Billing requirements and paper claim exceptions, Section 6.1 Electronic Billing.

- Electronic Data Interchange (EDI)

When submitting electronically, follow the instructions in the provider manuals at 6.14 Submitting Attachments for Electronic Claims.

Continue to complete the coordination of benefits information (report TPL and Medicare information) when submitting claims via DDE through the Provider Portal and EDI in the CAS segment of the 837 transactions.

Requirements:

- On the EOB, providers must write either “Medicare Advantage or Replacement” or “Medicare Supplemental” so Medicaid knows how to adjudicate the claim correctly.

- Provider initiated claim adjustments and voids must have an EOB or a Medicare EOB attached to the claims.

EOBs or Medicare EOBs are not required to be submitted with the following claims:

- Care Management Entity (CME) claims

- Children’s Mental Health Waiver (CMHW) claims

- Intermediate Care Facility Claims for individuals with Intellectual Disability (ICF/MD)

- Non-Emergency Medical Transportation* claims – taxi providers, non-taxi ride providers, and lodging providers (Refer to CMS-1500 Provider Manual, Chapter 23.1 Non-Emergency Medical Transportation).

- School-Based Services

- Waiver claims (including DD and CCW)

* An EOB is required for non-emergency ambulance transport if it is medically necessary and

there is a written order from a doctor stating that other transportation methods would endanger the health of the member. All other non-emergency medical transportation does not require an EOB.

Additionally, the following claims have specific exceptions:

- Medicare/Coordination of Benefits Agreement (COBA) claims that crossover directly from the Coordination of Benefits Contractor.

- These claims can be identified by the 1st and 2nd digits of the Medicaid TCN – “32” – Assigned to Crossover Claims – Received via Medicare Intermediary.

- An EOB is generally not required, unless the claim is submitted via DDE, paper, or EDI. In such cases, a Medicare EOB and any other applicable third-party liability EOB must be submitted.

- Nursing Facility (NF) Claims for room and board

- An EOB is not required unless the Medicaid member has long-term care coverage through a long-term care insurance plan and payments from the carrier are being made directly to the facility or the provider of service.

Note: Claim adjustments and voids will still require an EOB or a Medicare EOB to be attached.

- An EOB is not required unless the Medicaid member has long-term care coverage through a long-term care insurance plan and payments from the carrier are being made directly to the facility or the provider of service.

Please contact Provider Services at 1-888-996-6223 (1-888-WYO-MCAD) for billing questions regarding this billing requirement.

Provider & Enrollment Vendor Action Required for 1099 Forms!

Attention All Billing Providers & Enrollment Vendors!

Deadline: December 15, 2025, and Maintained Throughout the Year

Why It Matters:

The State Auditor’s Office (SAO) will mail 1099 Forms for 2025 by January 31, 2026, to the mailing address on provider’s most recent W-9 Form. If the 1099 Form is returned as undeliverable, Medicaid payments will be placed on hold and the provider’s enrollment status will be updated to “inactive”.

Providers are required to verify and update their mailing address with HHS Tech Group (Wyoming Medicaid’s Provider Enrollment vendor) no later than December 15, 2025, to allow for processing time.

Steps Providers or Enrollment Vendors Must Take:

- Verify Mailing Address

- Log into the HHS Tech Group provider portal https://wyoming.dyp.cloud/,

- Navigate to the Provider Data tab and verify the mailing address is accurate.

- If the mailing address is correct, call HHS Tech Group to request they verify the mailing address matches the one on file with the SAO.

- Update Address if Needed

- Complete and submit a Change of Circumstance (COC)* with HHS Tech Group at https://wyoming.dyp.cloud/landing.

- “How to Create A COC” training video can be viewed at https://wyoming.dyp.cloud/info-for-providers

- Next complete a new W-9 Form using the most current version of the W-9 Form available at https://sao.wyo.gov/vendors/.

- Ensure the updated mailing address matches the one submitted via COC.

- Submit the completed W-9 Form to HHS Tech Group:

-

- Email: wyenrollmentsvcs@hhstechgroup.com

- Mail to:

- Complete and submit a Change of Circumstance (COC)* with HHS Tech Group at https://wyoming.dyp.cloud/landing.

HHS Tech Group

2515 Warren Ave., Ste. 503

Cheyenne, WY 82001

*NOTE: Wyoming Medicaid must be able to reach every provider DIRECTLY via email and phone. This is a requirement of the Wyoming Medicaid Provider Agreement and Policy. While verifying your mailing address, please take the time to ENSURE at least one (1) email address and one (1) phone number belongs to:

- A practitioner

- An employee (e.g., office manager)

- Or a group email account within the provider’s actual office/facility.

These changes can be submitted in the same COC as the mailing address or separately.

Contact Information

Inquiries regarding provider enrollment, verification of demographics, completing a COC, or W-9 Form contact HHS Tech Group via email or phone:

- Email address: WYEnrollmentSvcs@HHSTechGroup.com

- Phone number: 1-877-399-0121

New IVR Access Requirements for Wyoming Medicaid Provider Services

Effective August 16, 2025, Wyoming Medicaid is implementing new Interactive Voice Response (IVR) access requirements for its Provider Services call center (1-888-996-6223) to enhance Medicaid data protection and self-service functions. Providers must have specific information ready before calling.

Required Information Combinations:

Preferred Option:

- Medicaid Provider ID (9-digits)

- WOLFS Vendor Control (VC) Number* (last 7-digits only)

Alternate Option:

- Medicaid NPI (10-digits)

- Primary Taxonomy

- WOLFS VC Number* (last 7-digits only)

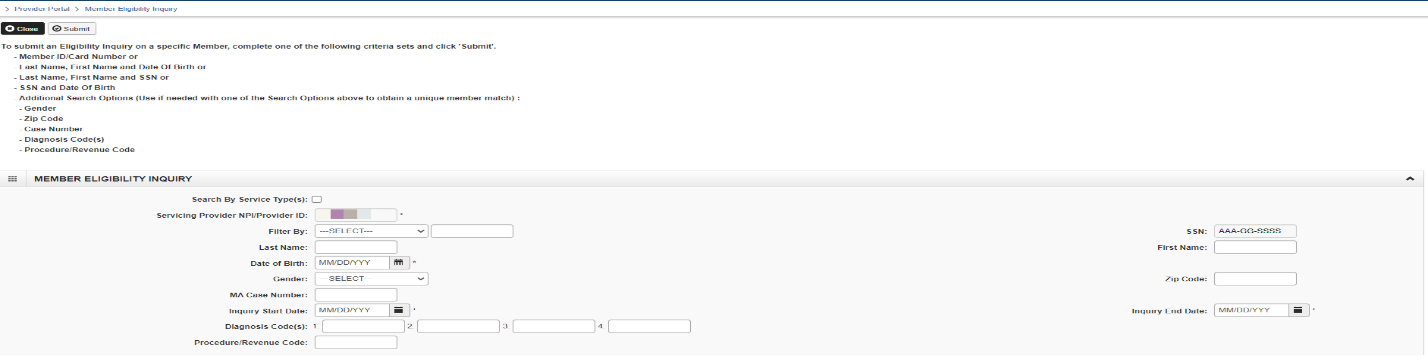

Locating Your VC Number and Primary Taxonomy in the Provider Portal:

Your VC Number and Primary Taxonomy can be found under the following profiles in the Provider Portal:Provider Access Profile:

- Provider Menu

- Manage Provider Information

- Step 3: Taxonomy Details (for Primary Taxonomy)

- Step 5: Identifiers (for VC Number)

- Manage Provider Information

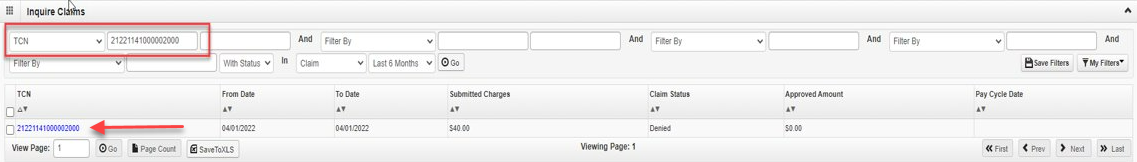

Claims Access Profile:

- Claims Menu

- Inquire Claims

- Locate a claim.

- Scroll down to "Billing Provider Taxonomy" for the primary taxonomy.

- The "Vendor ID" field (directly to the right) contains the VC Number. Copy or scroll to capture the last 7-digits.

- RA List Screen

- Search for your Remittance Advice (RA) number.

- The "Vender ID" (VC Number) is in the upper left of the RA.

- Important: Only RAs associated with the Provider Domain you are logged into will display.

- Inquire Claims

Claim Inquiry Profile:

- Inquire Claims (follow the same steps as listed above under Claims Access Profile)

A Provider Bulletin detailing these changes was sent to all active billing providers via email on August 12, 2025. The full provider bulletin is also available on the Wyoming Medicaid website at: https://uat.wy-bms.com/portal/Provider-Manuals-and-Bulletins/CMS-1500-Provider-Manual

BATH/SHOWER CHAIRS UPDATE

Attention DME Providers:

Effective August 1, 2025, Prior Authorization (PA) will now be required for HCPCS code E0240 Bath/shower chair, with or without wheels, any size.

Bath/shower chairs may be covered for members who are unable to safely and promptly access the bath/shower in the bathroom of their homes due to a medical condition, and who require significantly more positioning assistance than is available without a bath/shower chair. Providers should use the HCPCS code E0240 when billing for a bath/shower.

The policy regarding bath/shower chairs can be found in the DME Covered Services manual at https://wymedicaid.telligen.com/document-library/ within the Bath and Toilet Aids Section.

Any additional updated accessories must be medically necessary and provide assistance due to the member’s medical condition. Items are not considered medically necessary if they are for the convenience of the member or the caregiver.

All bath/shower chairs require a PA. However, items over the amount of three hundred dollars ($300) must also include a cost comparison of three similar items with MSRP showing that the provided item is the least costly option while still meeting the needs of the member.

BILLING WYOMING MEDICAID FOR DUALLY ELIGIBLE MEMBERS

Wyoming Medicaid has become aware that providers are not following Medicaid’s policy regarding dually eligible (Medicare and Medicaid) members.

BILLING REMINDERS:

- Wyoming Medicaid requires taxonomy codes to be included on all Medicare primary claim submissions for billing, attending, and servicing or rendering providers. Medicaid requires these taxonomies to get to a unique provider.

- Medicare is primary to Medicaid and must be billed first.

- When posting the Medicare payment, the EOMB may state that the claim has been forwarded to Medicaid.

- No further action is required; it has automatically been submitted.

- Medicare transmits electronic claims to Medicaid daily.

- Medicare transmits all lines on a claim with any Medicare paid claim.

- If payment is not received from Medicaid after 45 days of the Medicare payment, submit a claim to Medicaid and include the Coordination of Benefits (COB) information in the electronic claim.

- The line items on the claim being submitted to Medicaid must be exactly the same as the claim submitted to Medicare.

Exception: When Medicare denies, then the claim must conform to Medicaid policy.

- The line items on the claim being submitted to Medicaid must be exactly the same as the claim submitted to Medicare.

- The time limit for filing Medicare crossover claims to Medicaid is 12 months (365 days) from the date of service, or six (6) months (180 days) from the date of the Medicare payment, whichever is later.

NOTES:

- Do not submit a claim to Medicaid for coinsurance, deductible, and copayment amounts unless the provider has waited 45 days from Medicare’s payment date.

- Do not submit a “new” claim to Medicaid when the Medicare claim needs to be adjusted, (i.e., excluded a modifier).

- This may result in duplicate payment to providers.

- When providers receive a duplicate payment, they must determine the mistake and also make the necessary corrections to remedy the situation.

WYOMING MEDICAID PROVIDER MANUAL POLICY REFERENCES (ALL MANUALS):

- Chapter & Section: 3.2.2.2 Provider Taxonomy Requirements When Billing Medicare for Dually Eligible Members

- Chapter & Section: 6.5.2 Billing Information (Medicare Crossovers)

Provider Manuals and Provider Bulletins are located on the Wyoming Medicaid website: https://www.wyomingmedicaid.com/portal/Provider-Manuals-and-Bulletins

For questions, please contact Provider Services at 1-888-996-6223 (1-888-WYO-MCAD).

NEW POLICY FOR REPAIRS AND WARRANTIES

Attention DME Providers:

Beginning April 1, 2025, Wyoming Medicaid is changing the reimbursement policy for medical equipment maintenance, repairs and warranties.

Repairs

Repairs/modifications are covered to make equipment operable and will not exceed the cost of replacement. Providers should not bill for set up or assembly, however, if they are adding, changing, or modifying components, the provider needs to bill for their time using one of the repair codes. If a piece of equipment is billed with a specific HCPCS code, assembly is included in this reimbursement. A prior authorization for repairs should not be requested before determining the issue. The assessment would be considered part of the repair (an assessment could be billed if, for example, someone needed a new seat due to it no longer fitting).

Repairs/modifications should be billed using the appropriate code with the number of units based on the time the repair or modification takes. Units of service for repairs include basic trouble shooting, problem diagnosis, testing, cleaning, screws, nuts, bolts and cables, and other miscellaneous parts and accessories. HCPCS code K0108 can no longer be billed separately for repair parts. Items/parts/accessories with unique HCPCS codes may still be billed in addition to the repair code. Example: E2221 – solid caster tire (removable) for a manual wheelchair.

Repair Codes

- K0739 – repair or non-routine service for DME other than oxygen requiring the skill of a technician, labor component, per 15 minutes.

- K0740 – repair or non-routine service for oxygen equipment requiring the skill of a technician, labor component, per 15 minutes.

The rate for repair codes is being raised to $45.00 per unit to include miscellaneous parts and accessories used in the repair/modification. One unit of service equals 15 minutes.

Warranties

All standard DME must have a manufacturer’s warranty of a minimum of one (1) year. If the provider supplies equipment that is not covered under a warranty, the provider is responsible for any repairs, replacement, or maintenance that may be required within one (1) year.

DME suppliers must provide a one (1) year warranty of the major components for custom motorized/power wheelchairs unless the manufacturer’s warranty is longer.

- The main electronic controller, motor, gear boxes and remote joystick must have a one (1) year warranty from the date of delivery.

- Cushions and seating systems must have a one (1) year warranty for full replacement for manufacturer defects, such as if the surface does not remain intact due to normal wear.

- Powered mobility bases must have a lifetime warranty on the frame against defects in material and workmanship for the lifetime of the member.

- If the provider supplies a custom motorized/power wheelchair that is not covered under a warranty, the provider is responsible for any repairs, replacement, or maintenance that may be required within one (1) year.

When the item is under warranty and replacement is required, the provider is responsible for repairs and/or replacement. The warranty begins on the date of the delivery to the member.

- The provider must notify a member of warranty coverage and honor all warranties.

- The provider must not charge the member or the Medicaid program for services covered under warranty.

- Record of the warranty must be retained in the member’s record with the DME provider.

Wyoming Medicaid will only pay for the most cost-effective equipment that meets the needs of the member. Post pay reviews may be completed to ensure a DME provider is determining and documenting that the member has met all criteria.

PROVIDER TRAINING SURVEY – TRAINING OPTIONS

The field representatives are working to serve Wyoming Medicaid providers with targeted training and location preferences. The Provider Training Survey, linked below, offers providers an opportunity to submit feedback on these topics.

This Provider Training Survey should take about 5 minutes to complete. It supports providers by helping them share their struggles and communicate with the field representatives.

Thank you for your time and we are excited to support you in 2025!

URGENT – PROVIDER REVALIDATION

Providers have been required to revalidate their enrollment in PRESM after PHE ended 5/11/2023. Most providers have been revalidated, however, there are a few of you that have not. If you do not revalidate your provider enrollment by January 15, 2025, your claims will begin to be denied with error code:

- 5300 BILLING PROVIDER/VENDOR ID INACTIVE

To revalidate and avoid having your claims denied, please contact HHS immediately in one of the following ways:

Website: https://wyoming.dyp.cloud/landing

Phone: 1-877-399-0121

Email: WYEnrollmentSVCS@HHSTechgroup.com

WYOMING MEDICAID 2025 PAYMENT EXCEPTION CALENDAR

The 2025 Wyoming Medicaid Payment Exception Schedule has been posted to the Medicaid website: https://www.wyomingmedicaid.com/portal/Payment-Exceptions.

There are no payment exceptions for the months of January through June 2025. Payments will process according to the normal weekly payment schedule, as follows:

- The payment exception schedule documents the changes to the normal weekly payment schedule.

- Medicaid payment runs on Wednesdays, the State Auditor's Office (SAO) runs payment on Thursdays, and EFTs (electronic fund transfers) and check mail dates occur on Fridays.

- Paper Remittance Advices (RAs) and 835s are delivered on Fridays.

Reminder: EFT date is the date the SAO transmits the payment to banks (financial institutions), and they have up to three (3) business days to post to accounts.

Note: The 2025 Payment Exceptions occur in the months of July, November, and December.

1099 FORMS – VERIFICATION OF MAILING ADDRESSES

Attention All Billing Providers

Reminder! 1099 Forms will be mailed to providers in early 2025 to the provider’s mailing address that was entered on their W-9 Form.

When a 1099 Form is returned to the State Auditor’s Office as undeliverable, the provider’s Wyoming Medicaid payments will be placed “on hold” until a new W-9 Form is completed with the correct mailing address (P.O. Box is acceptable) and returned to Medicaid’s provider enrollment vendor, HHS Tech Group, to process. Updated W-9 Forms can be emailed to wyenrollmentsvcs@hhstechgroup.com or mailed to:

HHS Tech Group

2515 Warren Ave., Ste. 503

Cheyenne, WY 82001

All providers are encouraged to submit a new W-9 Form if there has been any change in address in the year of 2024. In addition, it is recommended to log into the HHS Tech Group provider portal https://wyoming.dyp.cloud/, navigate to the Provider Data tab and verify all addresses, phone numbers, and emails in each section to ensure they are up to date. Any updates must be made by completing/submitting a Change of Circumstance or CoC. The current version of the W-9 Form can be found at https://sao.wyo.gov/vendors/.

IMPORTANT! Wyoming Medicaid must be able to reach you, the provider, via email and phone.

While providers are reviewing addresses, they should also validate and update their email addresses to ensure, at a minimum one (1) email address is for an employee or group email account within the actual provider’s office/facility. Wyoming Medicaid communicates to providers via email and their provider enrollment status may be updated to “inactive” when emails bounce OR when emails are only directed to their vendors.

Providers are responsible for managing their vendors and ensuring they are following the most current Medicaid policies and billing requirements. Wyoming Medicaid and Acentra Health (Fiscal Agent) must be able to speak with the provider offices at any time.

Note: The provider record with HHS Tech Group must be reviewed and kept updated to avoid delays in Medicaid payment.

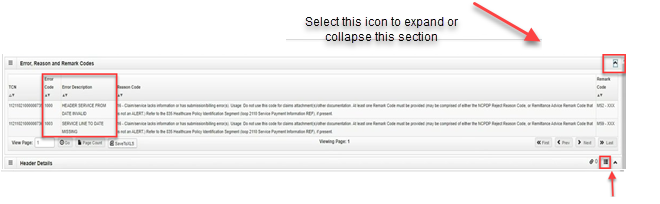

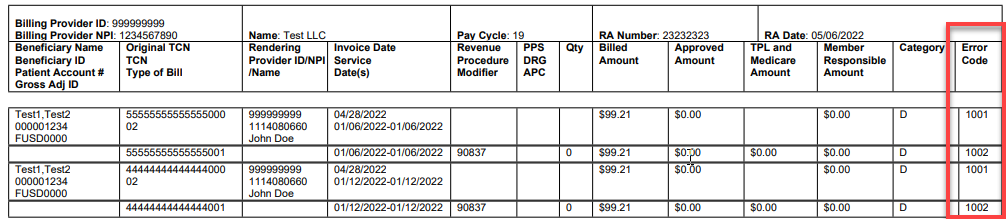

CHANGES TO REMITTANCE ADVICE

Attention Wyoming Medicaid Providers:

On December 16, 2024, the information supplied on the provider Remittance Advice (RA) has been updated to provide additional details. Updates included:

- Checks received by Acentra Health

- Claim number(s) the checks were applied to

- Payment after TPL (Primary insurance) is applied

- Patient Pay Amount (nursing home only)

- Total claim amounts with the claim status listed on the RA for the pay cycle

This new look will appear for providers on the RAs provided on and after December 20, 2024. The RA location will remain the same in the provider portal.

To support providers’ understanding of these changes, Acentra Health will conduct virtual provider trainings in January 2025. These provider trainings will be conducted via the GoTo Webinar platform and links will be made available on the provider training tab of the Wyoming Medicaid website: Provider Training, Tutorials and Workshops

For questions before the provider training occurs, please contact Provider Services at 1-888-996-6223 or via email at: wyprovideroutreach@acentra.com.

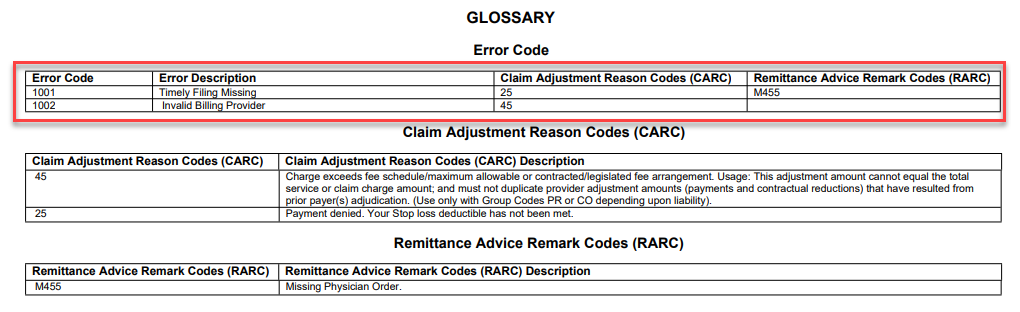

IMPLEMENTED ERROR CODES for COB PRIMARY INSURANCE

On October 12, 2024, the Division of Healthcare Financing/Wyoming Medicaid implemented new system error codes for other payer(s) coordination of benefits (COB) information. The error codes range from 7214 – 7219.

Claims will require that the Remittance Advice (RA) or Explanation of Benefits (EOB) match the amount listed on the claim. See below for some helpful hints to avoid claim denials when billing Wyoming Medicaid as secondary or tertiary payer:

- Do not submit MC – Medicaid as the Claim Filing Indicator in the COB information. Wyoming Medicaid does not consider MC – Medicaid as a liable third-party payer.

- Enter the appropriate paid amount from the other insurance accompanied with appropriate CARC codes and Group codes in the COB information.

- Report COB information at the header of the claim and at the individual line level of the claim. The BMS system will perform COB balancing at both the header of the claim and at the line level of the claim. For claims that process at the line level, the COB information must exactly match how the claim was submitted at the line.

WYOMING MEDICAID VIRTUAL 4TH QUARTER HOSPITAL MEETING

Attention Hospitals – Wyoming Medicaid Virtual Meeting on November 4, 2024!

Wyoming Medicaid will host a virtual meeting with hospitals on Monday, November 4th, 2024, at 10 am MST.

Hospital staff are urged to attend to discuss current issues affecting facilities throughout the State.

To ensure any issues or concerns you are encountering can be addressed, please supply claim numbers or any other information that can be researched before the meeting. Please send details directly to Elizabeth Lovell-Poynor (Elizabeth.lovell-poynor@wyo.gov) no later than Thursday, October 31, 2024.

Please note: Topics not received before the meeting may not be able to be addressed during the meeting depending on research required.

Quarter 4 Hospital Meeting

Monday, November 4, 2024, from 10 – 11 am MST

Video call link: https://meet.google.com/yts-itsq-akk

Or dial: (US) +1 402-839-8264

PIN: 373 591 744#

More phone numbers: https://tel.meet/soy-emti-mqx?pin=8908849553121

We look forward to meeting with you on November 4th!!

UPDATED WYOMING MEDICAID PROVIDER CONTACT EMAIL ADDRESSES

Attention All Providers: Updated Wyoming Medicaid Provider Contact Email Addresses

Acentra Health has created two new emails, one for correspondence/communication and a separate email for appeals, in an effort to streamline the process. The new email reflects the change in business name from CNSI to Acentra.

The new addresses are currently active and able to receive emails. Please utilize wyprovideroutreach@acentra.com for correspondence/communication and wyappeals@acentra.com for appeals.

You still have the option of submitting via the secure Provider Portal or via fax number at 307-460-7408. The new emails provide another option for the convenience of the provider.

The previous CNSI email addresses will be monitored until 12/31/2024.

Remember: Wyoming Medicaid communicates updates, policy, and other vital information primarily through email. It is a Medicaid requirement that providers keep their email addresses updated in the PRESM system. You can check your demographic information that is currently on file at https://wyoming.dyp.cloud/landing,or call 1-877-399-0121, or email WYEnrollmentsSVCS@HHSTechgroup.com.

Please make a note and add wyproviderservices@acentra.com to your valid emails. If an email is returned (bounces back), your provider number will be suspended, and payment will be held until the information has been updated in the PRESM system.

ATTENTION DME PROVIDERS – IMMEDIATE ACTION REQUIRED

Nursing Facility Members – Wheelchair Policies

Please review the policy regarding Nursing Facility Members – Wheelchairs, accessories and repairs for personal wheelchairs are included in the per diem for a resident of a nursing facility. However, under limited circumstances, the customization of a wheelchair may be covered outside the per diem with written prior authorization for the member’s permanent and full-time use.

For power wheelchairs, the member must be able to demonstrate through a trial period with a similar powered wheelchair, the ability to safely and independently operate the controls. The member must not exhibit any ONE of the significant conditions that limit ability to participate in daily activities including:

In addition, if a customized wheelchair is prescribed for nursing facility members, the physician must include a statement describing the rehabilitation potential and how the customized wheelchair will enhance the prognosis. A written discharge plan stating the planned date of discharge to home or to a non-nursing facility setting must accompany the request for the customized wheelchair.

This is not a new policy.

All parts of a wheelchair must be medically necessary. Wheelchairs should be the most cost effective to meet medical necessity. Repairs to wheelchairs will be approved for parts that are medically necessary. ex. A Bluetooth/voice controlled joystick is not medically necessary unless the individual is not able to physically maneuver. They must also have the cognitive ability to utilize the feature.

Post pay reviews may be completed to determine if the policy for wheelchairs is being followed and that the NH member is able to utilize and operate the wheelchair in their environment. If the member is not appropriate, claims will be voided.

Please make sure to review the DME manual to make sure that you have not missed any changes to policy. It can be found at https://wymedicaid.telligen.com/document-library/ under manuals.

Wyoming Medicaid

WYOMING MEDICAID VIRTUAL 3RD QUARTER HOSPITAL MEETING

Attention Hospitals – Wyoming Medicaid Virtual Meeting on August 5, 2024!

Wyoming Medicaid will host a virtual meeting with hospitals on Monday, August 5, 2024, at 10 am MST.

Hospital staff are urged to attend to discuss current issues affecting facilities throughout the State.

To ensure any issues or concerns you are encountering can be addressed, please supply claim numbers or any other information that can be researched before the meeting. Please send details directly to Elizabeth Lovell-Poynor (Elizabeth.lovell-poynor@wyo.gov) no later than Monday, July 29, 2024.

Please note: Topics not received before the meeting may not be able to be addressed during the meeting depending on research required.

Quarter 3 Hospital Meeting

Monday, August 5, 2024, from 10 – 11 am MST

Video call link: https://meet.google.com/vmm-zizw-wtx

Or dial: (US) +1 520-800-2357

PIN: 689 523 077#

We look forward to meeting with you on August 5, 2024!

IMPORTANT MEDICAID PA CLAIM DENIALS & WAIVER CLAIM DENIALS FOR MEDICARE!

ISSUE 1 – All Providers – Medicaid PA Claim Denials:

From dates 5/11/2024 through 5/13/2024, Medicaid denied, in error, claims submitted with prior authorizations (PAs) with modifiers with the following error code and CARC/RARCs:

- Medicaid Error Code: 1122 – Claim data not matching PA

- CARC Code: 15 – The authorization number is missing, invalid or does not apply to the billed services provider

- RARC Code: N54 – Claim information is inconsistent with per-certified/authorized services

Note: The impact is limited to PAs that have modifiers on the lines.

On Tuesday, 5/14/2024, Medicaid began holding all claims posting error code 1122.

Wyoming Medicaid Actions:

The system will be corrected on Monday, 5/20/2024, including the following:

- Denied claims will be resurrected and will be reprocessed in time for next week’s payment on Friday, 5/24/2024

- Held claims will be released for processing and Providers will see these claims on next week’s Remittance Advices (RAs)

- Exceptions:

- Claims posting other edits will process as per normal claims processing and Providers should work their RAs as normal.

- Error code 1122 may have been posted correctly and claims may be denied appropriately after they are released and resurrected.

ISSUE 2 – Waiver Providers – Waiver Claims Denied Due to Medicare:

Some Waiver claims were denied in error posting error code 7183 – Medicare on file not on claim.

Medicare editing should not have been applied to Waiver claims.

Wyoming Medicaid Actions:

- System editing was corrected late Wednesday, 5/15/2024

- Denied claims will be resurrected and Providers should see these claims on their RAs in the next 1 to 2 pay periods.

We apologize for the inconvenience and the delay in reimbursements,

Provider Services

Wyoming Medicaid

IMPORTANT WYOMING MEDICAID CLAIM INFORMATION

Attention FQHC, RHC, IHS Providers:

Issue:

From dates 5/11/2024 through 5/16/2024, Medicaid denied, in error, outpatient and dental encounter claims submitted by FQHC, RHC, and IHS Providers.

- These claims were denied with the following error code and CARC/RARCs:

- Medicaid Error Code: 7035 – Invalid FQHC/RHC/IHS Claim

- CARC Code: 16 – Claim/service lacks information or has submission/billing error(s)

- RARC Code: M51 – Missing/incomplete/invalid procedure code(s)

In the afternoon of 5/16/2024, Medicaid began holding FQHC, RHC, and IHS claims to avoid further impact to providers.

Wyoming Medicaid Actions

The system will be corrected on Monday, 5/20/2024, including the following:

- Denied claims will be resurrected and will be reprocessed in time for next week’s payment on Friday, 5/24/2024.

- Held claims will be released for processing and Providers will see these claims on next week’s Remittance Advices (RAs).

- Exception: Claims posting other edits will process as per normal claims processing and Providers should work their RAs as normal.

Provider Actions

No Provider action is required.

We apologize for the inconvenience and the delay in reimbursements.

Provider Services

Wyoming Medicaid

Durable Medical Equipment and Prior Authorization Reminders and Updates

Attention Durable Medical Equipment Providers:

Submitting Requests for Prior Authorizations

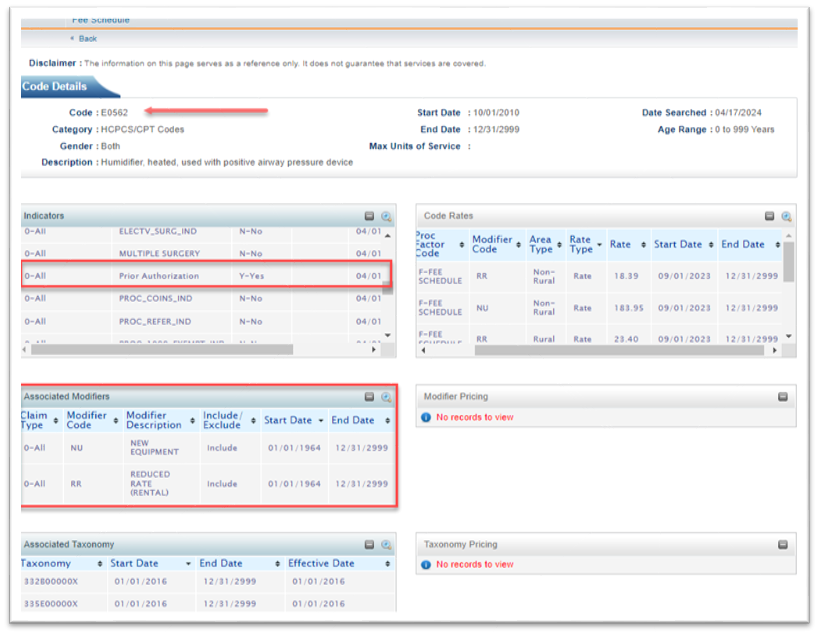

Requests sent to Telligen should not include codes that do not require a prior authorization. The fee schedule can be used to determine if a code requires a prior authorization and a modifier at https://www.wyomingmedicaid.com/portal/fee-schedules.

All codes, except those that are used for labor or repair, need to have the modifier NU for new equipment or RR for rentals. The NU and RR modifiers should also be part of the request for the prior authorization.

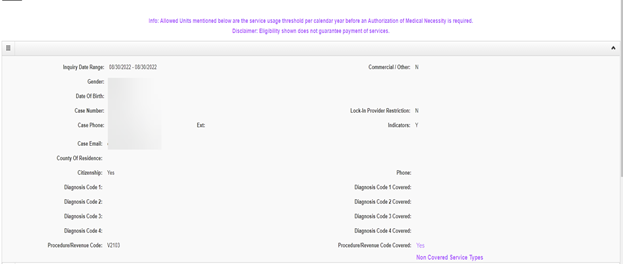

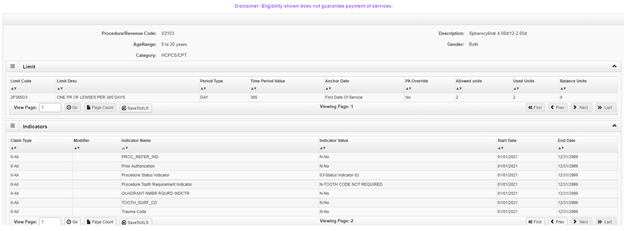

Online Fee Schedule example look-up for procedure code E0562:

Enteral Nutrition Changes

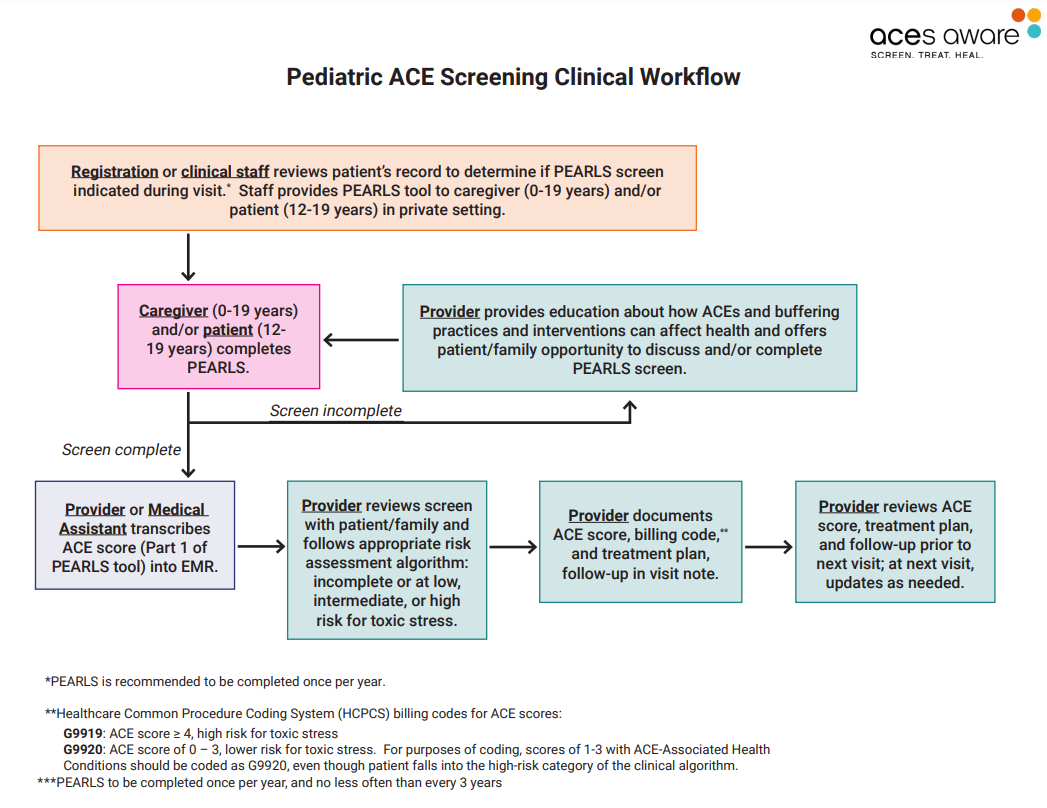

Effective for the date of service July 1, 2024, a prior authorization will be no longer be required for enteral nutrition. The procedure codes that will be impacted are listed below. The modifier BO must be used if the enteral nutrition is taken orally. For dates of service up to June 30, 2024, a prior authorization must be on the claim.

| Procedure Code | Procedure code desc | Procedure Code | Procedure code desc |

| B4100 | FOOD THICKENER | B4154 | ENTERAL FORMULA; CATEGORY IV |

| B4102 | INTERAL FORMULA, FOR ADULTS | B4155 | ENTERAL FORMULAE; CATEGORY V |

| B4103 | ENTERAL FORMULA, FOR PEDIATRICS | B4156 | ENTERAL FORMULAE; CATEGORY VI |

| B4104 | ADDITIVE FOR ENTERAL FORMULA | B4157 | ENTERAL FORMULA, NUTRITIONALLY COMPLETE |

| B4149 | ENTERAL FORMULA, BLENDERIZED NAT FOODS | B4158 | ENTERAL FORMULA, FOR PEDIATRICS |

| B4150 | ENTERAL FORMULAE; CATEGORY I | B4159 | ENTERAL FORMULA, FOR PEDIATRICS |

| B4151 | ENTERAL FORMULAE; CATEGORY I | B4160 | ENTERAL FORMULA, FOR PEDIATRICS |

| B4152 | ENTERAL FORMULAE; CATEGORY II | B4161 | ENTERAL FORMULA, FOR PEDIATRICS |

| B4153 | ENTERAL FORMULAE; CATEGORY III | B4162 | ENTERAL FORMULA, FOR PEDIATRICS |

Please make sure to continue to follow the criteria for approval of enteral nutrition in the DME manual.

Wyoming Medicaid will be completing reviews of member documentation and claims to determine if enteral nutrition was medically necessary according to the criteria. Please make sure you have all documentation, and the member has met all criteria.

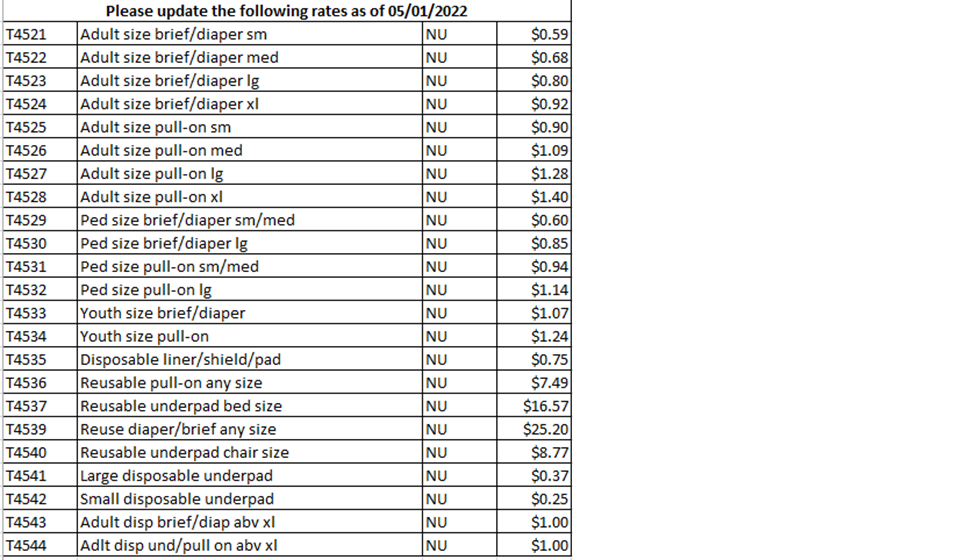

Incontinence Supplies

Incontinence supplies are limited to a 30-day supply. The provider must call the member to determine if additional supplies are needed before providing additional. This contact must be documented in the member records of the provider. The below codes are limited as indicated and when noted are a combined amount:

- T4521 – T4524 and T4529 – T4534: the combination of these procedures codes allows a maximum of 390 per calendar month

- T4525 – T4528 and T4543 and T4544: the combination of these procedures codes allows a maximum of 210 per calendar month

- T4535, T4541 and T4542: the combination of these procedures codes allows a maximum of 210 per calendar month

- T4536 – T4537: 4 each procedure code per calendar month

- T4539 – T4540: 3 each procedure code per calendar month

CPAPs, BIPAPs and Ventilators

Starting July 1, 2024, all continuous positive airway pressure (CPAPs), bi-level positive airway pressure (BIPAPs), and ventilators will require prior authorization. The requirement is for new and rental equipment. This includes codes E0465-E0467, E0470, E0471, E0561, E0562, E0601.

Humidifiers may be billed with CPAP and BIPAP if they are considered medically necessary.

Note: It is the responsibility of the provider to review the DME manual to determine if any changes have been made to policy. The DME manual is located under “manuals.” This manual was recently updated on April 1, 2024.

Interpreter Services Update

Attention All Providers:

Effective immediately, Wyoming Medicaid enrolled interpreters will again be able to bill Wyoming Medicaid directly for interpreter services. Wyoming Medicaid has determined that an access to care issue has occurred for members and will be reinstating the ability for interpreters to bill for these services.

- Interpreter providers enrolled with Wyoming Medicaid on July 1, 2023 will be reactivated.

- Interpreters not active with Wyoming Medicaid on July 1, 2023 will need to enroll to bill for their services. Complete the enrollment application via the HHS Provider Enrollment's portal through the following link: https://wyoming.dyp.cloud/landing

An interpreter must adhere to national standards developed by the National Council on Interpreting in Health Care (NCIHC). The interpreter must show certification of training in medical terminology or healthcare.

If a Wyoming Medicaid provider has their own interpreter that meets the criteria, they may still bill for the interpreter service.

Interpreter Providers:

The CMS-1500 Provider Manual will be updated with the July 2024 revision. Follow the billing procedures provided below:

- Interpreters may bill for the same member on the same day more than once if provided in conjunction with Medicaid healthcare services delivered by different providers.

- The diagnosis code for interpretation services is Z71.0.

- The procedure code for interpretation services is T1013, and interpreters must bill with the appropriate number of units provided.

- Example: One (1) unit = 15 minutes of service

- When not providing services in-person, interpreters must use the GT modifier.

Attention Hospitals – Wyoming Medicaid Virtual Meeting on May 6, 2024!

Wyoming Medicaid will host a virtual meeting with hospitals on Monday, May 6, 2024, at 10 am MST.

Hospital staff are urged to attend to discuss current issues affecting facilities throughout the State.

To ensure any issues or concerns you are encountering can be addressed, please supply claim numbers or any other information that can be researched before the meeting. Please send details directly to Elizabeth Lovell-Poynor (Elizabeth.lovell-poynor@wyo.gov) no later than Monday, April 29, 2024.

Please note: Topics not received before the meeting may not be able to be addressed during the meeting depending on research required.

Quarter 2 Hospital Meeting

Monday, May 6, 2024 from 10 – 11 am MST

Video call link: https://meet.google.com/eii-fuws-rvt

Or dial: (US) ) +1 205-649-0217

PIN: 591 101 921#

We look forward to meeting with you on May 6, 2024!

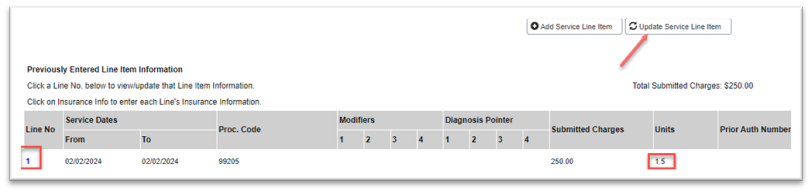

Partial Units and Claims DDE Warning Message:

Attention All Providers

Claims submitted to Wyoming Medicaid, on or after March 9, 2024, may be denied or paid with denied lines when submitted with partial units (e.g., 3.5 units).

New Claim Edit and Associated Claim Adjustment Reason Code (CARC)/Remittance Advice Remark Code (RARC):

- Edit 7212 – Unit(s) of service is partial and not valid.

- CO-16 – Claim/service lacks information or has submission/billing error(s).

- M53 – Missing/incomplete/invalid days or units of service.

Provider Portal – Direct Data Entry (DDE) Claim Submission:

For DDE claim entry, if partial units are entered in the “Units/Quantity” field in the “Basic Line Item Information” when “Add Service Line Item” is selected, a warning message will display at the top of the page but will not prevent the claim from being submitted.

Once the error appears, the provider may “edit” and “update the service line item” by clicking on the line number which will display the line details, then the units can be updated to a whole number.

Warning: Partial Unit(s) of Service were entered, please recheck the value

Important Change Healthcare (CHC) Outage Information:

Acentra Health is aware of the network and system outage at Change Healthcare. This outage is impacting pharmacies, members needing to fill prescriptions, and providers that use Change Healthcare as their clearinghouse for Medicaid claims submission.

Pharmacy Providers

If you are a pharmacy, please review communications here for additional information.

Medical, Dental, and Facility Providers

If you are a provider that uses Change Healthcare for non-pharmacy Medicaid claims submission, Acentra Health has provided information here to assist with claims submission until Change Healthcare is operational.

Members – Important Pharmacy and Prescription Information

Member Services is aware of the difficulties some may have experienced getting prescriptions filled. For more information click here.

IMMEDIATE ACTION NEEDED – EVV USAGE REQUIRED

Attention Home Health Provider:

PLEASE FOLLOW THE STEPS IN THE HOME HEALTH PROVIDER CHECKLIST BELOW TO AVOID PAYMENT DENIALS.

Please note that you must complete these enrollment tasks specifically for home health EVEN IF YOU ARE CURRENTLY ENROLLED WITH CAREBRIDGE for services associated with the Comprehensive, Supports, or Community Choices Waiver Programs.

Home Health Electronic Visit Verification (EVV) Is Live

The Wyoming Department of Health (WDH) expects Home Health providers to begin using EVV to submit electronically validated visits and generate claims as soon as possible, if not already enrolled and using EVV. Providers who perform any of the following Home Health services will be required to use EVV:

| Revenue Code | Revenue Code Description |

| 0421 | Physical Therapy |

| 0431 | Occupational Therapy |

| 0441 | Speech Therapy |

| 0550 | Skilled Nursing - General Classification |

| 0551 | Skilled Nursing |

| 0561 | Medical Social Worker |

| 0570 | Home Health Aide - General Class |

| 0571 | Home Health Aide |

| 0579 | Personal Care Attendant |

What’s Next?

WDH expects all contracted Home Health provider agencies to either utilize the CareBridge EVV solution at no cost to providers, or to successfully integrate your chosen EVV solution with CareBridge. The requirements for a compliant EVV system are outlined in the 21st Century Cures Act, a federal law that requires all states to implement EVV.

HOME HEALTH PROVIDERS CHECKLIST:

Home Health providers must take immediate action, including communicating with their chosen EVV vendor, confirming and identifying integration dependencies, and completing training. Please be prepared to complete the following steps:

- EVV Provider Setup and Vendor Selection:

- All providers must complete the EVV Provider Set Up & Access Form to inform CareBridge of what EVV Vendor your agency plans to use, as well as to identify the appropriate billing contact for your office.

- Agency Integration:

This step is not required if you are using CareBridge as your EVV solution.- If your agency will be using an EVV vendor other than CareBridge, it’s critical to share the following link with your EVV vendor as soon as possible: Third-Party EVV Vendor Intake Form

- Important: It can take up to eight weeks to complete the integration process with CareBridge, so it’s important to have your vendor start this process immediately.

- Training for Providers:

- Registration for training will be available soon. You can access this calendar and other training resources at the following link: https://www.carebridgehealth.com/trainingwyevv

- You can also view recorded training videos and other materials in CareBridge’s online resource library. The online library can be accessed 24/7 at the following link: http://resourcelibrary.carebridgehealth.com/wyevv

- Registration for training will be available soon. You can access this calendar and other training resources at the following link: https://www.carebridgehealth.com/trainingwyevv

Use EVV to Avoid Payment Delays

Provider agencies must begin utilizing EVV to document visits for required services. This will require all claims with dates of service on or after January 1, 2024 to be generated through the CareBridge EVV solution, or they will be denied, causing payments to be delayed. You can prevent this by enrolling with CareBridge or confirming your EVV vendor has completed the integration process with CareBridge and that all the required steps have been taken.

Want More Information?

For more information on CareBridge, EVV, and the 21st Century Cures Act or specific details Wyoming Home Health providers must stay current on, please visit CareBridge’s website: https://www.carebridgehealth.com/wyevv

Behavioral Health Providers Required to Enroll with Medicare

Centers for Medicare and Medicaid Services (CMS) will implement two (2) new behavioral health provider types effective January 1, 2024:

- Mental Health Counselor

- Marriage and Family Therapist

Wyoming Medicaid enrolls these two behavioral health provider types with the following taxonomies:

- 101YP2500X – Licensed Professional Counselors (LPC)

- 106H00000X – Licensed Marriage and Family Therapists (LMFT)

NOTE: CMS does not allow Provisional Marriage and Family Therapists (PMFT) to enroll with Medicare.

CMS Medicare Learning Network (MLN) New Provider Types 2024 Newsletter and Website:

CMS Provider Newsletter: New Provider Types 2024: Marriage and Family Therapists & Mental Health Counselors

CMS will implement marriage and family therapist and mental health counselor provider types on January 1.

You must enroll in Medicare to submit claims and get paid for covered items or services. You can start submitting enrollment applications after the CY 2024 Physician Fee Schedule final rule is on display at the Federal Register, usually around November 1:

- Your effective enrollment date won’t be earlier than January 1

- We’ll send an MLN Connects newsletter when it displays

In the meantime, find out how to become a Medicare provider, and get ready to enroll:

- Review the application: electronic version in PECOS or paper CMS-855I

- Gather your supporting documents

- Find your Medicare Administrative Contractor's website

- Sign up to get our weekly MLN Connects newsletter

More Information:

- Medicare Enrollment for Providers & Suppliers webpage

- FAQs

NOTE: The above content was taken directly from the CMS website. Go to the CMS Medicare website provided above and hyperlinks will be available to allow you to navigate to the specific Medicare sites referenced within the Medicare Newsletter.

Medicaid – Important Information:

- Wyoming Medicaid’s Provider Services Call Center cannot assist you with your Medicare enrollment or enrollment questions. Providers must follow Medicare’s instructions and guidelines.

- Providers are not able to opt out of enrolling with Medicare as Medicaid is the payer of last resort.

- Per Medicaid policy as outlined in the CMS-1500 Provider Manual, if you choose not to enroll with Medicare and accept a dually enrolled patient (eligible for both Medicare and Medicaid), you are not permitted to bill the Medicaid member for the services rendered.

- Providers must enroll in Medicare and submit claims to Medicare primary and Medicaid secondary or tertiary, effective with dates of service 1/1/2024 and forward.

- Claims received with dates of service 1/1/2024 and forward will be denied when the member is Medicare eligible, and Medicare payer data is not included on the claim with the following Error and CARC/RARCs:

- Error code: 7183 – Medicare on Recipient file, not on claim

- CARC: 97 – The benefit for this service is included in the payment/allowance for another service/procedure that has already been adjudicated.

- RARC: MA04 – Secondary payment cannot be considered without the identity of or payment information from the primary payer. The information was either not reported or was illegible.

- Below are key chapters and sections within the CMS-1500 Provider Manual that you should review due to this new requirement to submit claims to Medicare, but not limited to:

- Chapter 3.2 – Accepting Medicaid Members

- Section 3.2.2 – Provider-Patient Relationship

- Section 3.2.2.1 – Medicare & Medicaid Dual Eligible Members

- Section 3.2.2.2 – Provider Taxonomy Requirements When Billing Medicare for Dually Eligible Members

- Section 3.3 – Medicare Covered Services

- Section 3.5 – Medicaid is Payment in Full

- Section 3.2.2 – Provider-Patient Relationship

- Chapter 6 – Common Billing Information

- Section 6.5 – Medicare Crossover Claims

- Section 6.7 – Service Thresholds Per Calendar Year

- Section 6.10 – Co-Payment Schedule

- Section 6.16.6 – When a Member has Other Insurance

- Chapter 7 – Third Party Liability

- Chapter 12 – Covered Services – Behavioral Health Servicesy

- Section 12.3.6 – Behavioral Health Providers Eligible for Medicare Enrollment

- Chapter 12 will be updated in the coming months

- Chapter 3.2 – Accepting Medicaid Members

Update: Medicaid & United Healthcare (UHC) Advantage Plan Part B Denials & Provider Action

Summary of the Issue:

Claims billed to United Healthcare (UHC) Advantage Plans/United Healthcare D-SNP Plans as primary and submitted to Medicaid as secondary payer for calendar year 2023 dates of service were denied by Medicaid when the total Medicare Part B deductible amounts referenced on claims was greater than the annual Original Medicare Part B deductible amount.

Denied claims posted:

- Error Code 1058 – Medicare Deductible Amount Invalid.

- CARC 16 – Claim/service lacks information or has submission/billing error(s).

- RARC N48 – Claim information does not agree with information received from other insurance carrier.

Cause of the Issue:

Deductible rates set by CMS for UHC in calendar year 2023 were higher than the deductible rates CMS provided Wyoming Medicaid, causing error code 1058 to post and deny claims.

Actions Taken by Wyoming Medicaid

- On 11/8/2023, claims that were identified as entered with UHC as an other payer and with dates of service from 1/1/2023 to 10/18/2023 were either adjusted or resurrected. These claims should have appeared on provider RA/835 files beginning on 11/10/2023.

- On 11/30/2023, error code 1058 – Medicare Deductible Amount Invalid, was set to suspend for all claim types to allow the Claims Department to review and attempt to identify them as UHC claims and process as appropriate.

How Medicaid is Identifying UHC Submitted Claims:

- HIPAA submitted claims with the following:

- Payer ID: 87726 - United Healthcare, OR

- Payer Name: United Healthcare or UHC

- DDE submitted claims with the following:

- Payer ID: 87726 - United Healthcare

Reminder! Wyoming Medicaid provides a list of Payer IDs for provider reference and use, refer to the “TPL and Medicare Payer IDs” list posted on the Wyoming Medicaid website for accurate Payer IDs.

Provider Action Required:

You may have UHC claims that were not reprocessed (not identified as UHC) and claims submitted after the reprocessed date that are in the statuses of denied or paid (with line denials).

Timely filing is being waived for dates of service 1/1/2023 – 12/31/2023. This includes when the payment date is older than six (6) months (180 days) for adjusted claims.

Providers must take the following steps to be reimbursed by Medicaid:

- HIPAA Claims Submissions (837D, 837I, and 837P):

- For Denied claims:

- Submit a new claim, enter the ‘Payer ID’ as 87726 and/or enter the ‘Payer Name’ as UHC or United Healthcare.

- For Paid claims with denied lines::

- Adjust the paid claim and update the ‘Payer ID’ to 87726, and/or enter the ‘Payer Name’ as UHC or United Healthcare.

- For Denied claims:

- DDE (Direct Data Entry) Claims::

- For Denied claims:

- Submit a new claim, enter the ‘Payer ID’ as 87726.

- For Paid claims with denied lines::

- For professional/medical claims providers may submit the denied lines as a new claim.

- Additional information when adjusting claims via the Provider Portal:

- Enter the TCN to adjust, if the error message, ""Warning: TCN entered is not available to be replaced or is not located in [evoBrix X]"" displays, the claim payment date is older than six (6) months and you will need to void the paid claim, submit a new claim, and update the ‘Payer ID’ to 87726.

- If this error message does not display you may adjust the paid claim as it is within six (6) months and update the ‘Payer ID’ to 87726.

- For Denied claims:

We appreciate your patience in this matter,

Revised Policy! Two (2) Emergency Room (ER) Visits Within 24 Hours

Attention All Hospitals

Wyoming Medicaid has opted to go back to the previous policy when Wyoming Medicaid members are seen in the emergency room (ER) more than once in 24 hours:

- If more than one (1) visit to an ER takes place on the same date of service, the second or subsequent visits to the ER must be for medically necessary services. Any same-day subsequent visits to the ER must have medical documentation, of all visits, attached to the claim to receive reimbursement.

- All services provided to the Medicaid member by the hospital on the same day must be billed on a single claim.

Chapter 10.6 in the Institutional Provider Manual will be updated with the January 2024 version to reflect this updated policy and billing requirements. Providers are encouraged to review Chapter 10.6, Emergency Department Services, in its entirety.

For information on attaching medical documentation to a claim, please review Chapter 6.14, Submitting Attachments for Electronic Claims, or contact Provider Services at (888) 996-6223.

IMPORTANT – Provider Action Required!

- Please disregard the provider email communication sent on 9/25/2023. Providers do not need to submit appeals.

- Providers must resubmit any claims which previously were denied, for 2 ER visits within 24 hours, and attach supporting documentation. The claims’ processing system has been updated to route these claims as appropriate.

We appreciate your feedback and patience while we resolved this situation in the best interest of our Providers.

Wyoming Medicaid

Inpatient Medicare Primary Observation Claims Update (Error Code 7000)

Wyoming Medicaid has been denying Inpatient claims when the admit date is greater than 48 hours before the “from” date of service entered on the claim and Medicare is the primary payer. The claims in the Wyoming Benefit Management System (BMS) are being denied and posting error code 7000, CARC 110, and RARC MA40.

- Error code 7000 – First DOS versus admission date conflict.

- CARC 110 – Billing date predates service date.

- RARC MA40 – Missing/incomplete/invalid admission date.

Wyoming Medicaid has made the decision to allow payment when Medicare is the primary payer on Inpatient claims. Error code 7000 was updated on 11/22/2023, from an auto deny edit disposition to a pay and report edit disposition for Inpatient claims. Pay and report edits will appear on your Remittance Advice (RA)/835 for provider and Medicaid information.

The Fiscal Agent will be resurrecting denied claims received from 10/25/2021 to 11/22/2023, and providers should watch for these to appear on upcoming RA/835 files.

We appreciate the feedback we received from providers on this topic.

Wyoming Medicaid

Attention Home Health Providers – Immediate Action Required!

Electronic Visit Verification (EVV) will be made available for Home Health providers on December 18, 2023. Home Health providers will have the choice to use the State’s free available EVV solution hosted by CareBridge, or use a chosen third-party EVV vendor, as long it complies with the 21st Century Cares Act and can integrate successfully with the CareBridge EVV solution.

Effective January 1, 2024, specific Home Health claims must use EVV. Any Home Health claims where the Member has Medicare on the claim and no condition code associated with the claim will need to enter claims directly into the Wyoming Benefit Management System (BMS). All other Home Health claims will need to be generated by the CareBridge EVV solution (from completed EVV Home Health visits within CareBridge or through data aggregation from a 3rd party EVV solution). Claims will be denied if they are not entered into the correct system.

Home Health providers must complete the following tasks even if you are currently using EVV for services associated with the Comprehensive, Supports, or Community Choices Waiver Programs:

- EVV Provider Set up and Access Form

- 3rd Party EVV Vendor Integration – not required if you are using CareBridge as your EVV solution.

- If using a vendor other than CareBridge to submit EVV data, share the following link with your EVV Vendor and have them complete the Third-Party EVV Vendor Intake Form

- Training – Access the training calendar and videos and resources on the CareBridge online resource library

Complete the above steps to alleviate the chance of payment delays and denied claims.

Make sure your staff is trained on the EVV Home Health solution as soon as possible!

For more information on CareBridge, EVV, and the 21st Century Cures Act, or specific details Wyoming Home Health providers must stay current on, please visit the CareBridge website.

1099 Forms – Verification of Mailing Addresses

Attention ALL Billing Providers

Reminder! 1099 Forms will be mailed to providers in early 2024 to the provider’s mailing address that was entered on their W-9 Form.

When a 1099 Form is returned to the State Auditor’s Office as undeliverable, the provider’s Wyoming Medicaid payments will be placed “on hold” until a new W-9 Form is completed with the correct mailing address (P.O. Box, is acceptable) and returned to Medicaid’s provider enrollment vendor, HHS Tech Group, to process. Updated W-9 Forms can be emailed to wyenrollmentsvcs@hhstechgroup.com or mailed to HHS Tech Group 2515 Warren Ave., Ste. 503, Cheyenne WY 82001.

All providers are encouraged to submit a new W-9 Form if there has been any change in address in the year of 2023. In addition, it is recommended to log into the HHS Tech Group provider portal https://wyoming.dyp.cloud/, navigate to the Provider Data tab and verify all addresses, phone numbers and emails in each section to ensure they are up to date. Any updates must be made by completing/submitting a Change of Circumstance or CoC. The current version of the W-9 Form can be found at https://sao.wyo.gov/vendors/.

IMPORTANT! Wyoming Medicaid must be able to reach you, the provider, via email and phone.

- While providers are reviewing addresses, they should also validate and update their email addresses to ensure, at a minimum one (1) email address is for an employee or group email account within the actual provider’s office/facility. Wyoming Medicaid communicates to providers via email and their provider enrollment status may be updated to “inactive” when emails bounce OR when emails are only directed to their vendors.

- Providers are responsible for managing their vendors and ensuring they are following the most current Medicaid policies and billing requirements. Wyoming Medicaid and Acentra Health (Fiscal Agent) must be able to speak with the provider offices at any time.

NOTE: The provider record with HHS Tech Group must be reviewed and kept updated to avoid delays in Medicaid payment.

EVV ANNOUNCEMENT FOR HOME HEALTH PROVIDERS

The Wyoming Department of Health (WDH) is pleased to announce its continued partnership with CareBridge as their Data Aggregation solution, ensuring WDH and the Home Health provider community complies with the 21st Century Cures Act. CareBridge’s Data Aggregation solution will focus on collecting and reporting EVV compliant data for all required Home Health services. Through this partnership, Home Health providers will be able to leverage, at no cost, CareBridge’s EVV solution to capture electronically validated visits.

The WDH expects Home Health providers to begin using EVV to submit electronically validated visits and generate claims no later than January 1, 2024. Home Health providers are strongly encouraged to begin using EVV as soon as it’s available on November 1, 2023 to allow time to prepare for this change. Over the next few weeks, CareBridge will be supporting WDH in the efforts to prepare providers to successfully use EVV beginning November 1, 2023.

Providers who perform any of the following Home Health services will be required to use EVV:

| Revenue Code | Revenue Code Description |

| 0421 | Physical Therapy |

| 0431 | Occupational Therapy |

| 0441 | Speech Therapy |

| 0550 | Skilled Nursing - General Classification |

| 0551 | Skilled Nursing |

| 0561 | Medical Social Worker |

| 0570 | Home Health Aide - General Class |

| 0571 | Home Health Aide |

| 0579 | Personal Care Attendant |

What’s Next?

WDH expects all contracted Home Health provider agencies to either utilize the CareBridge EVV solution at no cost to providers, or to successfully integrate your chosen EVV solution with CareBridge. The requirements for a compliant EVV system are outlined in the 21st Century Cures Act, a federal law that requires all states to implement EVV.

HOME HEALTH PROVIDERS CHECKLIST:

Home Health providers must take immediate action, including communicating with their chosen EVV vendor, confirming and identifying integration dependencies, and completing training. Please be prepared to complete the following steps:

- EVV Provider Setup and Vendor Selection:

- All providers must complete the EVV Provider Set Up & Access Form to inform CareBridge of what EVV Vendor your agency plans to use, as well as to identify the appropriate billing contact for your office.

- Agency Integration: This step is not required if you are using CareBridge as your EVV solution.

- If your agency will be using an EVV vendor other than CareBridge, it’s critical to share the following link with your EVV vendor as soon as possible: Third-Party EVV Vendor Intake Form

Important: It can take up to eight weeks to complete the integration process with CareBridge, so it’s important to have your vendor start this process immediately. - Training for Providers:

- Registration for training will be available soon. You can access this calendar and other training resources at the following link: https://www.carebridgehealth.com/trainingwyevv

- You can also view recorded training videos and other materials in CareBridge’s online resource library. The online library can be accessed 24/7 at the following link: http://resourcelibrary.carebridgehealth.com/wyevv

- Registration for training will be available soon. You can access this calendar and other training resources at the following link: https://www.carebridgehealth.com/trainingwyevv

All provider agencies must:

- Promptly read and act on any communication from WDH pertaining to EVV.

- Begin using EVV as soon as possible:

- CareBridge Users: Register for and attend CareBridge-hosted training sessions or use the CareBridge online resource library to learn how to use EVV.

- Providers using other EVV Vendors: Communicate with your EVV vendor the need for them to complete the CareBridge Third-Party EVV Vendor Intake Form to begin the integration process with CareBridge and use the CareBridge online resource library to learn more about the integration process.

- Train your caregivers on how to use EVV to document visits.

These three steps are the keys to your agency having success using EVV.

Use EVV to Avoid Payment Delays

We encourage you to begin using EVV as soon as it’s available on November 1, 2023 to allow time to prepare for this change. Over the next few months, CareBridge will be supporting WDH in the efforts to prepare providers to successfully use EVV.

You can avoid payment delays by using CareBridge EVV early, or by confirming your approved EVV vendor has completed the integration process with CareBridge and is ready to submit EVV visits to the CareBridge EVV solution.

Want More Information?

Provider agencies must begin utilizing EVV to document visits for required services by January 1, 2024. This will require all claims with dates of service on or after January 1, 2024 to be generated through the CareBridge EVV solution, or they will be denied, causing payments to be delayed. You can prevent this by attending training or confirming your EVV vendor has completed the integration process with CareBridge and that all the required steps have been taken.

For more information on CareBridge, EVV, and the 21st Century Cures Act or specific details Wyoming Home Health providers must stay current on, please visit our website: https://www.carebridgehealth.com/wyevv

Urgent DME Provider Update

Effective September 1, 2023, code A4554 (disposable underpads, all sizes) will be closed and no longer billable to Wyoming Medicaid.

The following codes will still be opened to use for underpads:

- T4541 – Large disposable underpads, each -24” x 36” and larger- $0.60

- T4542 – Small disposable underpads, each - 17” X 24” up to 23” X 36”- $0.45

Note: These codes are limited to 7 per day or 210 per calendar month.

For all disposable equipment, providers must contact members to confirm that the item continues to be needed. Documentation of this must be in the Durable Medical Equipment (DME) provider notes.

Per Wyoming Medicaid/Telligen Supplies and Equipment Provider Manual (DME manual https://wymedicaid.telligen.com/document-library/):

Confirmation of Continued Need – A confirmation that the item continues to be needed by the member. Documentation of this must be in the DME provider notes for the member.

- Ongoing need for and use of an item must be documented in member records in order for Wyoming Medicaid to continue reimbursement for equipment or supplies.

- Information used to justify continued medical need must be timely for date(s) of service under review.

- Retrospective attestation statements by provider or the member is not sufficient.

- Contact with the member or designee regarding refills must take place no sooner than 24 calendar days prior to the delivery/shipping date

Refill record must include:

- Member name and/or designee if different

- Description of item being requested

- Date of refill request

- Verification of quantity of item and that it will be exhausted by refill date

Example: If an item is ordered monthly, the provider must contact the member ahead of scheduled delivery to determine if item(s) are still needed. This contact must be in the DME provider’s documentation.

Confirmation is needed to alleviate the chance of stockpiling.

Stockpiling – To accumulate and save excessive and inappropriate amounts of supplies for future use leading to waste and abuse of the healthcare system

- Example: Requesting more than one month of supplies, not confirming continued need or amount and auto shipping

Medicaid & United Healthcare (UHC) Advantage Plan Part B Claim Denials

Claims billed to United Healthcare (UHC) Advantage Plans/United Healthcare D-SNP Plans as primary and submitted to Medicaid as secondary have been denied by Medicaid when the total Medicare Part B deductible amounts referenced on claims are greater than the annual Medicare Part B deductible amount as described below. These claims are posting Error Code 1058, Medicare Deductible Amount Invalid. Due to the complexity of the issue, it has taken time to determine the root cause and resolution to these claim denials.

Wyoming Medicaid and the Benefit Management System and Services (BMS)

The Division of Healthcare Financing, Wyoming Medicaid, and their Fiscal Agent, Acentra Health (formerly CNSI), verified the 2023 Medicare Part B deductible amount of $226 was entered accurately into the Benefits Management System and Services (BMS) system.

*On September 27, 2022, the Centers for Medicare & Medicaid Services (CMS) released the 2023 premiums, deductibles, and coinsurance amounts for Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts.

Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The annual deductible for all Medicare Part B beneficiaries is $226 in 2023, a decrease of $7 from the annual deductible of $233 in 2022.

*Note: To view the complete CMS Fact Sheet: “2023 Medicare Parts A & B Premiums and Deductibles 2023 Medicare Part D Income-Related Monthly Adjustment Amounts” go to: https://www.cms.gov/newsroom/fact-sheets/2023-medicare-parts-b-premiums-and-deductibles-2023-medicare-part-d-income-related-monthly

The DHCF has determined that United Healthcare (UHC) has entered the Medicare deductible amount incorrectly, which is causing Wyoming Medicaid provider claims to deny when members have an active UHC Advantage Plan/United Healthcare D-SNP Plan.

Medicaid validates Medicare Part B deductible amounts on claims and will continue to deny claims when the deductible amount is exceeded.

This calculation considers a member’s claims submitted with dates of service within calendar year 2023, with CARC PR-1, and summarizes the deductible amounts entered on each claim. Once the member’s total deductible amount exceeds $226 for the year, error code 1058 – Medicare Deductible Amount Invalid, posts and denies the claim.

Quick Summary:

- BMS is processing UHC Advantage Part B claims correctly.

- BMS is not functioning any differently than the Medicaid Management Information System (MMIS) Legacy system.

- It has been identified that UHC has the Medicare Part B deductible amount set in their system at the incorrect dollar amount of $233 instead of $226 for calendar year 2023.

- Wyoming Medicaid will continue to deny these claims until UHC updates their system with the correct deductible amount, reprocesses these claims, and issues corrected explanation of benefits (EOBs).

Provider Actions:

- Providers are encouraged to contact UHC, as Wyoming Medicaid is not able to assist in this matter.

- Providers should continue accepting members covered under the UHC Advantage Plan/UHC D-SNP Plans, per Wyoming Medicaid policy in the Provider Medicaid manuals, which may be discriminatory if members with a UHC policy are denied services (Chapter 3.2, Accepting Medicaid Members).

- If a Provider chooses to opt-out of participation with a health insurance or governmental insurance, Medicaid will not pay for services covered by, but not billed to, the health insurance or governmental insurance.

- Once providers receive corrected UHC EOBs they may submit new claims to Medicaid for payment.

- When entering UHC (Other Payers) information enter the “Claim Filing Indicator” as MB-Medicare Part B, this applies to physician services, outpatient hospital services, durable medical equipment, and other medical and health services not covered by Medicare Part A.

Note: Wyoming Medicaid Provider Manuals, Chapter 7, Medicare Replacement Plans

Medicare Replacement Plans are also known as Medicare Advantage Plans or Medicare Part C and are treated the same as any other Medicare claim. Many companies have Medicare replacement policies. Providers must verify whether a policy is a Medicare replacement policy. If the policy is a Medicare replacement policy, the claim should be entered as any other Medicare claim.

Updated Coverage of Cologuard

Attention Providers:

Effective immediately, Wyoming Medicaid has opened CPT code 81528: At Home Colon Cancer Screening Test for Adults aged 45 plus (Cologuard). Members aged 45-plus, covered by a Wyoming Medicaid full coverage plan will be eligible for this service. Wyoming Medicaid has opted to backdate the effective date of this code to October 1, 2022.

Cologuard must be prescribed by a physician, or other appropriate medical professional, and is limited to the billing taxonomy of 291U00000X, Clinical Medical Laboratory. Reimbursement for Cologuard has been set at $457.98 and does not require prior authorization. Members aged 45-plus are eligible for one (1) screening per 3 years.

Please refer to the Wyoming Medicaid Fee Schedule to verify covered procedure codes as well as the Medicaid State Health Care Benefit Plans document to review specific plan details.

If you have additional questions, please reach out to Provider Services at 1-888-996-6223.

Implementation of 277CA Functionality in BMS

Attention all Providers, Clearinghouses and Billing Agents:

Effective July 29, 2023, Clearinghouses and Providers will receive 277CA Claims Transaction Acknowledgements. This will give Providers an immediate response for every claim they submit that has been received and processed in the Benefit Management System (BMS).

- Providers will receive the TCN number in the 277CA for each of the claims accepted in the BMS for adjudication.

- Providers will know the rejection status in the 277CA so they can resubmit the claim quickly.

- 277CAs will result in reduced claims processing time in the BMS, reduced Provider inquiries, and increased Provider satisfaction.

- 277CA flow: 837 > 999 > 277CA > Claim processed > 835.

Note: If the 999 is rejected, there won’t be a 277CA generated. - Clearinghouses that receive the 277CA will parse out the contents to each of their Providers.

- Providers do not need to do anything; the 277CA will be sent automatically.

Note: Providers, Billing Agents and Clearinghouses are encouraged to review the updated Wyoming Medicaid EDI Companion Guide for the 277CA transaction and file details.

Reprocessing of Paid Outpatient Claims (OPPS)

Attention Outpatient Providers: With the outpatient (OPPS) claim defects being resolved, Wyoming Medicaid and CNSI will begin reprocessing paid outpatient claims (OPPS). Mass adjustments will start with the claim submission date of 10/24/2021 to 5/6/2023. Due to the volume of claims, there will be many mass adjustments over the next several weeks. The results of a claim adjustment may be an increase or decrease in payment, or a previously paid claim being denied and the original TCN being voided. If the claim payment nets the same payment amount, the TCN will not be adjusted.

Provider Taxonomy Requirements when Billing Medicare for Dually Eligible Members

Wyoming Medicaid requires taxonomy codes to be included on all Medicare primary claim submissions for billing, attending, and servicing/rendering providers. Medicaid requires these taxonomies to get to a unique provider.

Medicaid receives Medicare claim (COBA) files daily and when the BMS is not able to identify the unique billing provider, the claims are denied and will not appear on the providers Remittance Advice (RAs)/835s. Providers are not aware of the claims crossing over and denying. Providers will not be able to locate them within the Provider Portal either.

The Wyoming Medicaid provider manuals are posted to the Wyoming Medicaid website. Providers should refer to Chapter 6.5 – Medicare Crossovers, specifically Section 6.5.2 – Billing Information.

- If payment is not received from Medicaid after 45 days of the Medicare payment, submit a claim to Medicaid and include the Coordination of Benefits (COB) information in the electronic claim.

Note: The line items on the claim being submitted to Medicaid must be exactly the same as the claim submitted to Medicare, except when Medicare denies, then the claim must conform to Medicaid policy. - Providers must enter the industry standard X12 Claim Adjustment Reason Codes (CARCs) along with the Claim Adjustment Group Codes from the Explanation of Medical Benefits (EOMB) when submitting the claim via a clearinghouse or direct data entry (DDE) via the Provider Portal.

- Providers may enter Remittance Advice Remark Codes (RARCs) when submitting a HIPAA compliant electronic claims transaction (837).

Medicaid has denied thousands of claims from approximately 325 providers that did not include their billing provider’s taxonomy when submitting claims primary to Medicare.

Billing Provider/Credentialing Staff Action Steps:

- Review and verify that all provider NPIs on the claim have an associated taxonomy.

- If you are submitting taxonomies on the Medicare claims and they are NOT automatically crossing to Medicaid, verify that Medicaid has these taxonomies on file as well.

- To verify and update information, billing providers may access their provider enrollment file by logging into your Provider Portal and submit a “Change of Circumstance”, if applicable, with HHS Tech Group, the Provider Enrollment vendor.

- Training materials are listed under ""Info for Providers"" on the DYP, HHS Tech Group website

- Questions regarding enrollment or Change of Circumstances that are not addressed in the training materials may be directed to:

- Email address: WYEnrollmentSvcs@HHSTechGroup.com or

- Phone number: 1-877-399-0121

- Allow 1 to 2 business days for updates (Change of Circumstances) to appear in the Wyoming Medicaid Provider Portal prior to submitting claims.

- If all enrollment information is accurate, verify your software is transmitting taxonomies for all providers (billing, attending, and/or rendering) when submitting claims to Medicare.

Discontinuance of Call Center Services for Billing Agents/Clearinghouses and their Third-Party Vendor Calls

Attention All Providers:

Effective July 1, 2023, billing agents/clearinghouses and their third-party vendor representatives calling to obtain basic claim status information will be referred to the provider (you) that they are billing for to obtain 835 details or access to the Provider Portal if the representative does not have access to the Provider Portal (user name).

Initial claim status information must be provided by the provider to their associated vendors. Wyoming Medicaid Provider Services Call Center will no longer assist third-party vendor agents with initial claim status.

Note: If the vendor has a legitimate question regarding an edit, a denial reason, or an issue with the Provider Portal, they will still be able to obtain assistance through the Call Center

Billing Provider’s Responsibilities

To ensure there is no delay in receipt of claims processing information, please ensure that your office has completed the following:

NOTE: If the billing provider does not wish to grant Provider Portal access to their vendor, then the billing provider is responsible to provide all necessary materials to their vendor.

- Billing Provider Contact Information – Wyoming Medicaid Requirement

- At a minimum, one (1) email contact and phone number for the individual/clinic/facility needs to be on file for the actual enrolled provider’s office. It is critical that the contact listed for the provider routes to the appropriate billing supervisor/manager or department.